US pays 39 GHz band incumbents $3.1bn to vacate it

News article

US regulator the Federal Communications Commission (FCC) has revealed that of the $7.6 billion in revenue from "Auction 103", $3.1 billion was spent on credits to allow incumbents to reorganize their spectrum assets at 38.6—40 GHz.

Mar 25, 2020 by Toby Youell Research Analyst

Tags: 37.6-40 GHz, 47 GHz, 47.2-48.2 GHz

The auction was the biggest millimetre wave (mmWave) auction yet held in terms of the number of MHz sold and revenue generated. Over 14,000 licences were assigned for the 37.6—40 GHz and 47.2—48.2 GHz bands in the USA’s 416 partial economic areas.

… the transfer of rents for repurposing spectrum is based on political decisions to grant licences in perpetuity

The auction included an incentive element designed to address incumbent licences that did not match the new bandwidths and geographic areas. This worked by granting the licence holders credits that matched the $/MHz/POP value of their licences, which is discovered as the auction progresses. These could be cashed in or used as a credit for their own auction participation.

By far the two biggest holders of these licences were companies now owned by the two largest mobile operators in the US: Verizon and AT&T. These companies would have received $1.8 billion and $1.2 billion if they surrendered the licences for cash. Instead, these amounts were put towards bids for additional spectrum rights worth a total of $3.4 billion and $2.4 billion. These two companies won the majority of licences from 37.6 GHz to 39.8 GHz.

The other big winner was T-Mobile, whose gross bids were $931.6 million for its new spectrum licences. However, it also relinquished some rights for $58.8 million. The third player was the biggest winner of spectrum at 39.8—40 GHz and 47.2—47.6 GHz, and also won hundreds of licences at 39.4—39.8 GHz.

A company controlled by Dish, the satellite TV company thought to be about to build a nationwide mobile broadband network, spent $202.5 million on new spectrum. It did not receive any incentive payments. It won almost all of the licences for the 47.6—48.2 GHz band, as well as a small number at 37.6—38.4 GHz. A company controlled by the fourth largest mobile operator, Sprint, also spent $113.9 million on new spectrum licences.

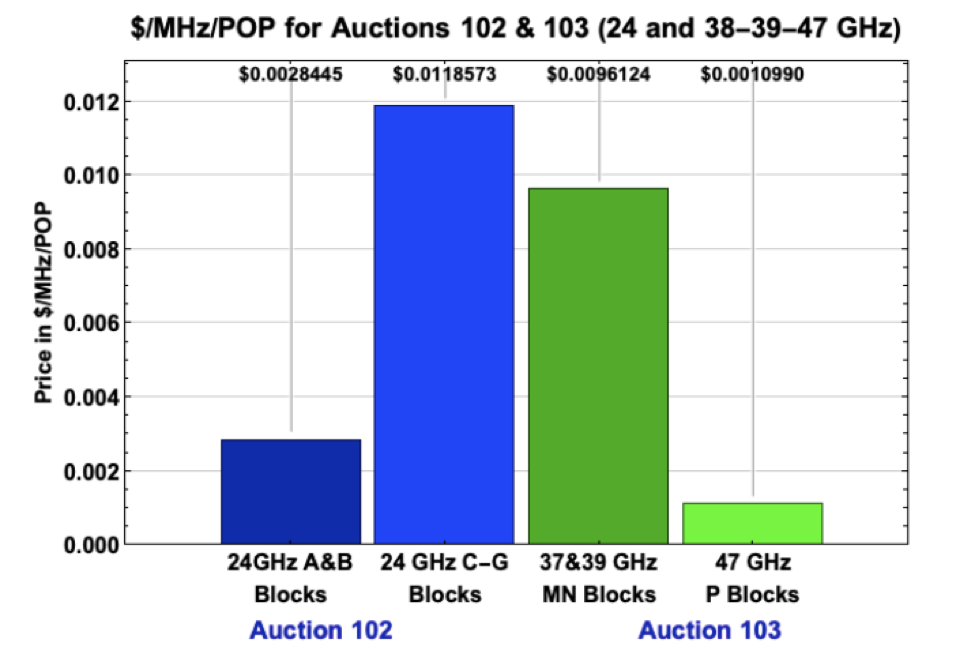

“M” and “N” blocks comprise the 37.6 – 38.6 GHz and 38.6 – 40 GHz band. “P” blocks are at 47.2 – 48.2 GHz. All blocks are 100 MHz. Source: Stephen Wilkus of Spectrum Financial Consulting

Half of the 10 companies relinquishing spectrum rights decided to take the money and run. These companies received a total of $36.4 million. The rest of the money was pumped back into the auction.

David Salant, senior managing director at FTI Consulting, said the incentive mechanism successfully reconfigured licences by paying licensees off. He sees this as a useful tool in the US context, where licences are awarded with an expectation of renewal in perpetuity, which means that repurposing spectrum tends to involve a transfer of rents. In most other countries regulators have different options because the licences are issued with a fixed duration—a situation that Salant views as providing regulators more flexibility.

“Personally, I feel that the transfer of rents for repurposing spectrum is based on political decisions to grant licences in perpetuity,” he said.

Steve Wilkus, principal at Spectrum Financial Consulting (SFC), which has analysed the auction extensively, told PolicyTracker that the incentive mechanism worked very well as it allowed almost all of the 39 GHz band spectrum to be transferred from one use to another. It might be a bit awkward for the FCC, he said. The regulator recently rejected these types of market mechanisms to repurpose the 3.7—4.2 GHz band, choosing instead to force reallocation at a fixed price by fiat.

“It seems at odds with the recent ideology and the growing spirit of the times of allowing industries to negotiate among themselves in an auction, but when nationalism comes into play, I guess economic theory goes out of the window,” Wilkus said.

Auction 103 also marked the world’s first award of the 47.2—48.2 GHz band. The spectrum was widely identified for IMT at WRC-19 but no other country has yet articulated any plans to award it. Licences for these bands sold at a much lower price, $0.0011/MHz/POP, than in the 37.6—40 GHz band, which generally sold for the equivalent of $0.0096/MHz/POP, according to SFC’s calculations. SFC’s analysis showed that these licences sold for even lower amounts than licences sold in 2019 at 24.25—24.45 GHz, where there were issues related to adjacent passive space-borne radars.

Wilkus found that the auction valued the 47 GHz band as worth 1/840th of the 600 MHz band on a $/MHz/POP basis. “Higher frequencies are problematic on a number of technical levels, most of which can be solved with some extraordinary engineering,” he said, but these solutions tend to be very expensive.

Source: Stephen Wilkus of Spectrum Financial Consulting

Wilkus told PolicyTracker that the low prices for the 47 GHz band licences may be a function of clever auction strategies.

“It is hard to justify the difference in prices that were paid but I think we can see there was some good tactical auctioneering at play in the auction,” he said. This involved the opportunistic use of bidding units.

Salant was optimistic about the prospects for the 47 GHz band in the future. He told PolicyTracker that its propagation characteristics are not much worse than for the 37.6—40 GHz band, so operators may find that it is a cost-effective way to add capacity to a network. He expects that other countries using the band will adopt the bandplan established in the US.•